Case Study Agriculture

Defending Market Position Through CX Improvement in the Agriculture Industry

Customer Experience dynamics in Agriculture are changing rapidly. Digital solutions are evolving, new interaction and purchase channels are emerging, and Farmers increasingly expect more from manufacturers and retailers alike.

In order to unlock market share in this new world, adding value to Grower operations by creating high-impact customer interactions that improve loyalty is paramount. By providing an in-depth understanding of what your customers need and expect, The Verde Group can help you avoid loyalty erosion and stay ahead of your ever-evolving environment.

Client Background

Our Client — a leading manufacturer of agricultural products and services in North America — partnered with The Verde Group to conduct annual CX performance and loyalty tracking of farmer end-customers, comparing key metrics and trends with those of its primary competitor. The purpose of this tracking study was to identify areas of strength and opportunity over time and to trigger necessary investments to mitigate risks as shifts in market dynamics occur.

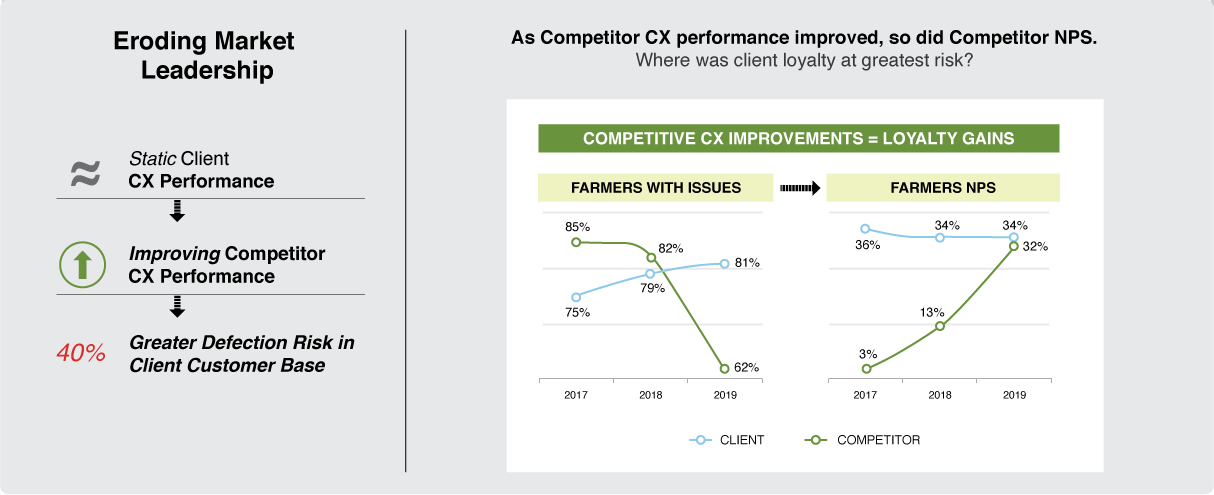

In 2017, our Client enjoyed a material advantage in both loyalty and quality of CX as measured by farmer problem frequency. But in 2018 these advantages began to weaken, and by 2019 our Client found itself at competitive parity with regards to loyalty, and appreciably under-performing the competition with respect to CX quality. This data trend triggered executive action and CX improvement initiatives.

To provide our Client the data and insights necessary to develop an action plan to reverse these trends, The Verde Group conducted a deep dive on the tracking data to determine the specific drivers of the loyalty erosion and what investment action would protect farmer customer spend and share-of-seed behaviors.

How We Helped

Because the research tracker was purposefully designed to support Revenue@Risk®, The Verde Group had the data necessary to zero in on the specific friction points in the Client’s go-to-market approach driving their loyalty erosion.

Our Revenue at Risk Solution

Revenue@Risk® analysis is a unique, proprietary analytic methodology that quantifies the financial impact of customer problems to answer these key business questions:

- Which experiences matter most to the recurring revenue and profit potential of my business?

- Which CX moments of truth are causing the greatest risk to my top line?

- What specific CX actions should I prioritize to improve my market share?

Through the Revenue@Risk® analysis, the Verde Group assessed both the changing problem profiles of the Client and their primary competitor relative to farmer customers’ loyalty dynamics and future spend intentions. This analysis delivered a clear and prescriptive action map for reversing the loyalty erosion of the previous three years.

Key Insights

-

For the Client, farmer (customer) loyalty dropped by 50% when an issue occurred

This explained the macro-dynamics of their loyalty erosion: Client farmers were experiencing a slight-but-steady uptick in problem frequency over the three years of tracking, while competitive farmer customers enjoyed a significant reduction in relationship problems over the same period. -

Client Farmer “Net Future Spend Intention” was stable

However, competitive Farmer customers reported a dramatic increase in future intended spend, portending future share pressures for our Client. -

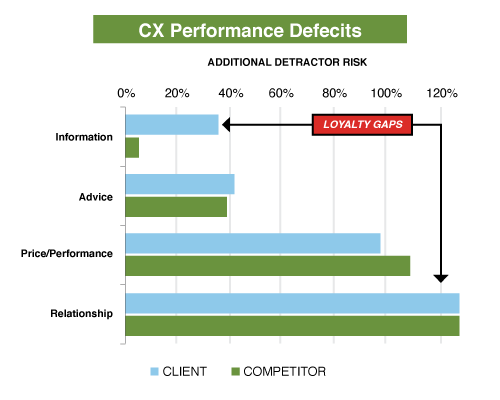

Primary risk areas and improvement opportunities were clear and unambiguous

With respect to identifying the specific areas of CX performance deficit leading to our Client’s loyalty loss relative to the competition, the Revenue@Risk® analysis uncovered the following: (see chart below) -

CX Parity in areas of Advice and Price/Performance

On average the client was at CX parity with the competition in areas of agronomic advice and product performance.

Impact and Outcomes

With these insights from The Verde Group Revenue@Risk® analysis in hand, our Client undertook two specific courses of action.

Re-examination of Delivery/Positioning of Product Information

An internal review of marketing materials revealed that the perception of bias had less to do with the materials and more to do with how performance data was presented to both Farmers and Dealers.

- This insight drove a revision and re-emphasis of communication and competitive product training for agronomists and field reps.

Double Down on Reward & Recognition

Recognizing the seriousness of this dissatisfier, the Client piloted a new Farmer Reward & Recognition program for high-value customers. This program recognized customer spend behaviors with a blend of financial and non-financial rewards.

- Compared to a control group, customers treated with this program showed an 11-point improvement in NPS, and a 12-point improvement in future spend intent. Based on these results, the Client rolled the program out to all high-value row crop Farmers.