Case Study Financial

Accelerating Investor Acquisition by Dominating at Customer Experience

The North American financial investment services industry is highly competitive and volatile. Consumers are concerned about managing their financial future, more savvy in looking for financial organizations that create the greatest value for them, and more demanding in seeking to work with advisors who provide personal, timely, accessible, and relevant service. In this industry, the cost of both customer acquisition and switching are high. Consequently, delivering an excellent investor experience is critical to maintaining and growing market share.

Client Background

The Client is a leading financial investment firm in North America, offering financial advice and investment services. Their Financial Advisors work closely with investors to understand financial needs and create plans to support investor goals. Advisors provide advice on a range of financial areas including investments, insurance, debt management, legal, trust and retirement planning.

The competitive environment in investment services is dense with both traditional and non-traditional players. The Client is primarily competing with traditional banks offering investment services, however, non-traditional players, particularly in the online space have entered the market as well.

The Client engaged The Verde Group to help them deeply understand the competitive landscape, and how banks were failing to deliver an acceptable customer experience (CX) to their investors. In addition, the Client wanted to specifically understand how to differentiate their own CX performance in order to maximize acquisition and retention of new investors.

The Client sought to explore:

- Understand the “Mass Affluent” customer segment with respect to investor demographics, psychographics, attitudes toward investing financial literacy and future goals

- Understand the friction points Mass Affluent investors encounter while working with their investment provider: the specific negative experiences that drive an investment customer to move their investment assets from one firm to another

- Understand the high impact areas to improve their customer experience (CX) and service capabilities in order to maximize investor loyalty and retention

How We Helped

The Verde Group worked alongside the Client to deliver a detailed analysis quantifying which experiences matter most to investors, and which negative experiences were the most damaging to investor asset retention. The proprietary methodology used in this analysis is based on a fundamental principle of human behaviour: customers are more likely to take action in response to negative events than positive ones, and as a result, negative experiences are the strongest predictors of customer behaviour.

The analysis was both qualitative and quantitative. The qualitative study explored key themes and characteristics of shaping investor loyalty behaviours and provided the Client a deep understanding of investor experiences with both the Client and competitors. This work amassed an extensive inventory of specific positive and negative experiences likely to influence customer market behaviours.

The quantitative phase of the work surveyed over 1,000 investors online who had responsibility for some or all investment decisions in their household and had investible assets of up to $2 million dollars. This phase rigorously evaluated the potential problems from the qualitative work and quantified their damage to loyalty and retention. The analysis cut through the complexity of the investor experience by identifying which specific problems were most likely to prompt investors to move assets from one firm to another.

Our Revenue at Risk Solution

Revenue@Risk® analysis is a unique, proprietary analytic methodology that quantifies the financial impact of customer problems to answer these key business questions:

- Which experiences matter most to the recurring revenue and profit potential of my business?

- Which CX moments of truth are causing the greatest risk to my top line?

- What specific CX actions should I prioritize to improve my market share?

These insights helped the Client understand what mattered most to investors, prioritize key areas of focus, and design an acquisition strategy that would enable them to capitalize on bank competitors’ CX points of weakness.

Key Insights

-

Most investors found their Financial Institution easy to work with

Most trusted their financial advisor and had confidence in their advice. However, there was a higher likelihood that investors of large institutional banks would switch to another firm within the next 3 years. -

Investors below the age of 55 were less likely to be promoters of their firm

This younger group was less likely to find their Financial Institution easy to work with, less likely to recommend their Financial Advisor and more likely to express intent to move investments. Those aged 30 – 44 were most at risk for switching. -

Nearly 50% of investors experienced problems working with their firm

Investors who experienced a problem experienced nearly 30% drop in loyalty. Effective resolution of these problems nearly completely recovered the investor loyalty lost due to problem experience. However, only 50% of investors who sought help from their firm or advisor were completely satisfied with the assistance they received.

Close to 100 problems were analyzed across the customer journey, revealing that 17 were highly likely to prompt investors to move assets to another firm. -

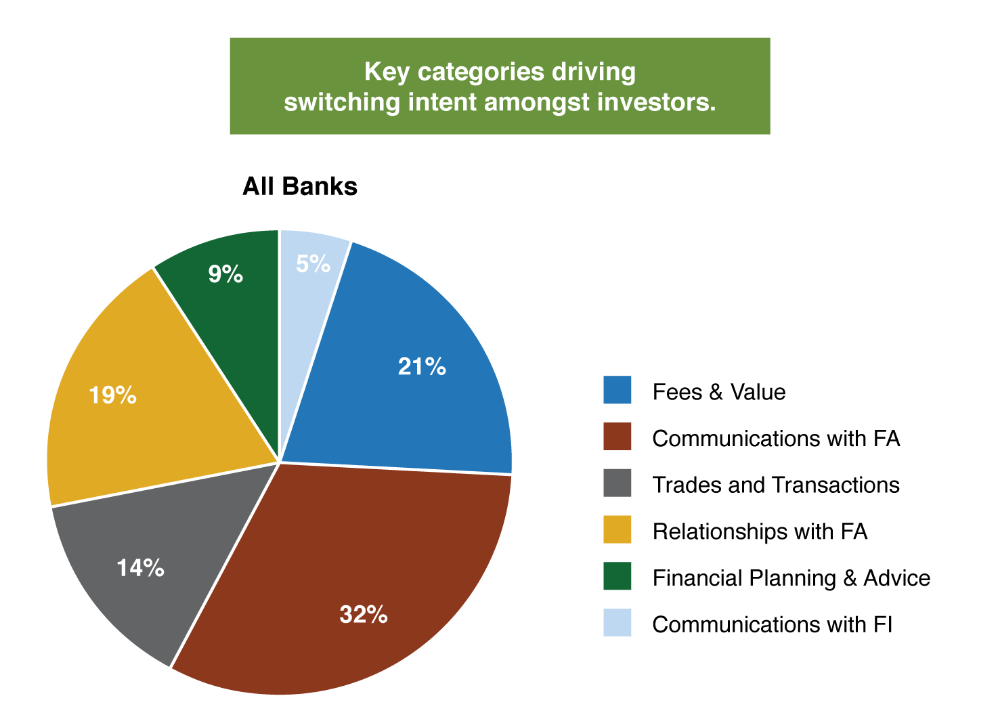

Across the board, there were significant points of failure in the investor experience

Not surprisingly, the analysis validated that advisor fees and value are a damaging problem. But the findings also revealed that problems related to the advisor relationship, financial planning and advice and communications were creating significant loyalty risk and switching intent. Among the topmost damaging problems (in the voice of the investor) were:- My Financial Institution does not reward and recognize me for the amount of business I do with them. This problem occurred most frequently for investors.

- My Financial Advisor does not proactively reach out to me to check in on my financial situation, adjust my financial plan or recommend changes to my portfolio AND My Financial Advisor does not proactively reach out to me around key dates/deadlines such as for investment contributions or when my goals in my plan are reached. This group of problems indicated an opportunity for advisors to support their investor Clients to educate them and feel more confident.

- My Financial Advisor didn’t’ have all my application paperwork ready for me to sign at one time in one setting. This problem speaks to the importance of effectively onboarding a new investor and creating a positive experience at the outset.

Impact and Outcomes

The analysis armed the Client with the insight necessary to create an acquisition strategy that would migrate investors from their current banking relationships. Understanding clearly and in detail which investor problems were most likely to drive switching informed broad market messaging, targeted acquisition collateral and advisor training on key message points to deliver when meeting with a prospective investor with assets in a traditional retail bank. The work also delivered to the Client a much deeper understanding of their own investors, enabling the Client to prioritize and action CX experiences that mattered most to drive customer loyalty and retention.

At a Tactical Level, the Work Identified Key Areas for Improvement:

- Ensuring the onboarding process, communications and channels easily delivered on the investors’ need for comprehensive information.

- Empowering Financial Advisors responsible for building business with information that supported them in understanding drivers of switching and loyalty.

- Prioritizing Financial Advisor training to ensure that advisors were servicing customers effectively through proactive outreach, financial education and a commitment to ongoing service and support.