Case Study Logistics

Prioritizing CX Improvements in the Shipping/Logistics Industry

Customer Experience dynamics of shipping and logistics are changing rapidly. Digital solutions are evolving, ecommerce growth is accelerating, and both shippers and recipients increasingly expect more from retailers and shipping companies.

In order to unlock market share in this new world, adding value by creating high-impact customer interactions that grow loyalty is paramount. By providing an in-depth understanding of what your customers need and expect, The Verde Group can help you avoid loyalty erosion, drive spend and share and stay ahead of your ever-evolving environment.

Client Background

The Client – a leading global shipping and logistics company – was seeking a better understanding of the key CX components within its competitive landscape, including:

- Which customer experiences were most influential on shifting spend and share-of-ship

- Where those experiences were occurring within the customer journey, and how they differed by customer type (B2B/B2C, Shipper/Recipient, etc.)

- How their CX performance measured up against that of key competitors

Understanding the science behind The Verde Group’s Revenue@Risk® methodology, our Client knew that the key to radically improving their CX performance was in understanding the nature of problems and friction points damaging customer equity. The over-arching purpose of their partnership with The Verde Group was to identify the specific customer experiences hurting loyalty across a wide range of channels and circumstances.

How We Helped

To provide our Client with the data and insights necessary to guide CX improvement investment and gain competitive advantage, The Verde Group conducted a deep dive Revenue@Risk® baseline study with over 4,500 Client customers and an additional 3,200 Competitive customers.

Our Revenue at Risk Solution

Revenue@Risk® analysis is a unique, proprietary analytic methodology that quantifies the financial impact of customer problems to answer these key business questions:

- Which experiences matter most to the recurring revenue and profit potential of my business?

- Which CX moments of truth are causing the greatest risk to my top line?

- What specific CX actions should I prioritize to improve my market share?

With the data from Revenue@Risk® analysis in hand, The Verde Group zeroed in on the specific friction points driving loyalty erosion with the Client’s Shipper and Recipient customers. The insights derived from the analysis provided our Client with a baseline view of their current CX, while also highlighting those CX areas that delivered the highest ROI in terms of loyalty growth and friction reduction. This equipped our Client with the insights necessary to focus their CX improvement efforts based on clear financial prioritization.

Key Insights

-

The Client and the competition were at parity with respect to customer loyalty across customer types

The Client was not doing any better or worse than their competitors. -

Over 85% of the Client’s B2B and B2C customers were experiencing problems

While these customers were almost half as loyal as customers who were problem-free, virtually all loyalty could be regained through effective problem resolution. -

Not all problems were equally damaging

Of the 60+ problems posed to customers, only half had an impact on loyalty, with 13 problems accounting for 70-80% of all loyalty and effort risk. In addition, it was further identified that over half of those were related to Customer Support. -

Customer Support-related problems were 30x more damaging to loyalty than shipping-related issues

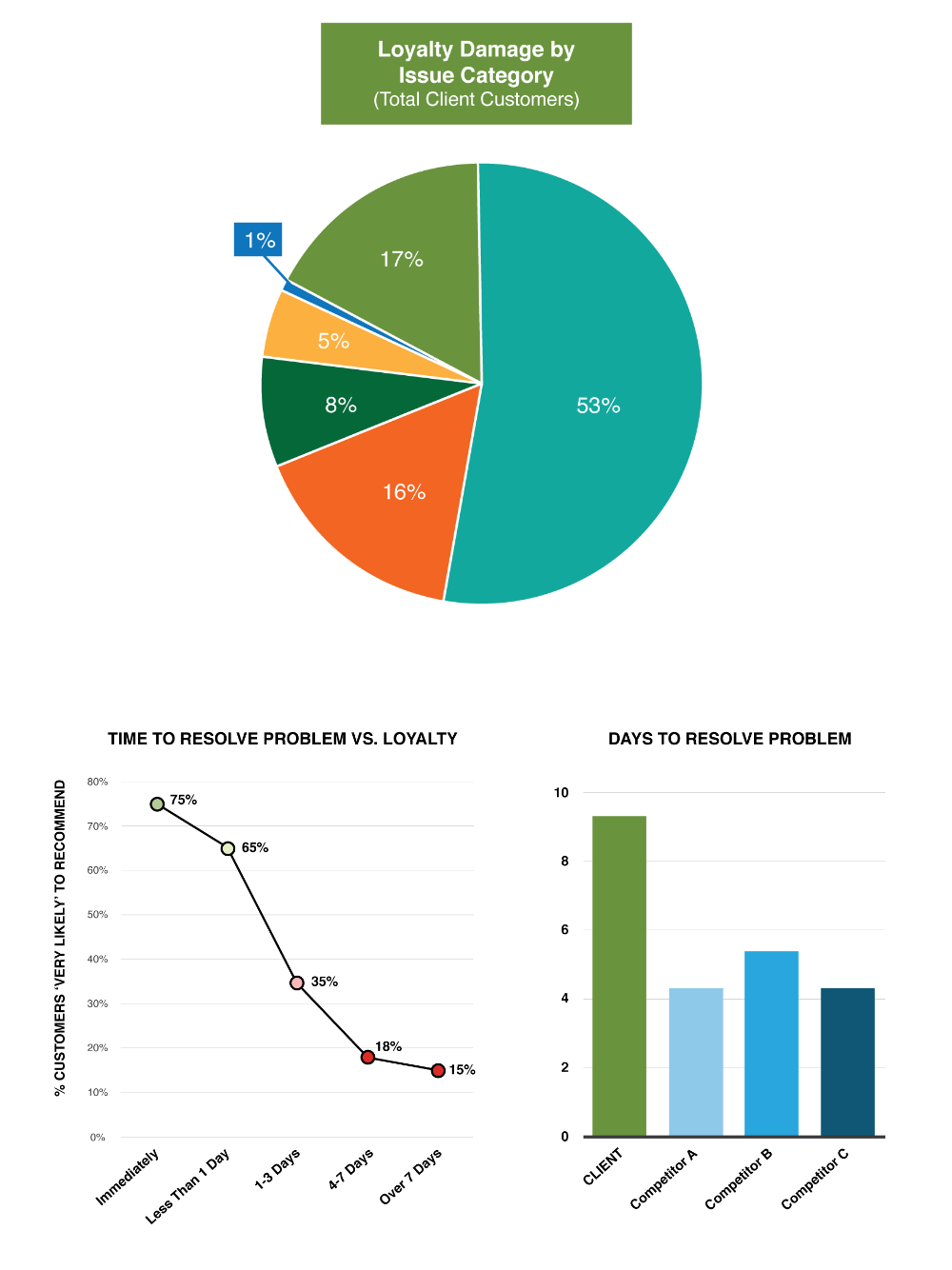

Nearly 50% of the Client’s B2B and B2C customer loyalty risk arose from problems related to Customer Support problems vs. shipping/logistics “core business” problems. (see pie chart) -

Speed of problem resolution was a key competitive risk area

Analysis showed that customer loyalty dropped precipitously as time-to-resolve elongated. And the Client was significantly under-performing competitors in this critical area. (see below)

Impact and Outcomes

Upon acting on the insights from the Revenue@Risk® study, our Client realized three significant areas of benefit:

“Quick Win” Improvements in Customer Support Phone Handling and Measurements

- Revenue@Risk® research revealed that nearly 20% of customers experienced problems with long hold times. This insight led the Client to revise hold time measurement and better align Customer Support staff scheduling to match call volumes, resulting in a 30% reduction in hold time issues.

A Robust “Voice of Customer” CX Tracking and Actioning Program

Through initiatives identified by the regular monitoring of performance, improvements were realized in several of the top pain point areas including:

- 50% improvement in getting customers connected to a live rep asap

- 65% reduction in the number of customers aggrieved by needing to re-explain their issue to multiple reps as they sought to resolve their problem

- 35% reduction in time to resolve customer problems

Infrastructure Investments Directly Aligned with the highest ROI CX Gaps

- The Client enhanced their CRM system to enable predictive caller intent (i.e., predicting why the customer is calling and what tracking number(s) they are calling about) to speed call handling times and reduce the need for callers to repeat information. This initiative reduced call handling time and cost to serve while improving CX.