Case Study Manufacturing

Leveraging the Dealer Network to Shift Manufacturing CX into High Gear

The capital goods industry has experienced accelerated growth and extensive change in the past decade, driven by market forces and trends including globalization, digitalization, automation, and alternative fuels. The Customer Experience (CX) dynamics of manufacturing have evolved as customers seek incremental value for their capital investment. In agriculture in particular, manufacturers continued to innovate agricultural equipment and technology to help farmers meet the demands of modern farming and ensure optimal performance and productivity.

Client Background

The Client is a global leader in the manufacture and sale of agricultural, construction, and powertrain equipment. While they were focused on growing their business globally, they were also experiencing year-over-year sales declines across some key brands. They heard the voice of their customers demanding an evolved service model, but they did not know how to tactically improve customer centricity through their field and dealer network.

The Client sought to explore:

- Which moments matter most to their customers?

- How effective is the Client in delivering on those moments across their channels?

- How effective is the Dealer experience for the customer?

- What actions should they take in order to improve the experience and deliver the largest shift in customer loyalty?

- What is more influential on customer loyalty – positive or negative experiences?

How We Helped

The Verde Group used its proprietary Revenue@Risk® methodology and worked closely with the Client to analyze the specific experiences that matter most to customer loyalty. The analysis is grounded in the Experience, Attitude, Behaviour (EAB) Consistency Model which recognizes that experiences with a brand are the core driver of customer attitudes and behaviours. Given that a brand cannot change attitudes, the analysis measures positive and negative experiences for a customer and quantifies which are most damaging to the Client.

For this analysis, Verde prioritized and quantified the customer experiences that had the greatest impact on driving Dealer loyalty given how critical the Dealer network was to the Client’s success.

The analysis was both quantitative and qualitative. Qualitative research was conducted with Client executives, Dealers, and customers to understand the current CX landscape and the problems customers were experiencing. The analysis resulted in an extensive inventory of both positive and negative experiences likely to influence customer market behaviours.

Our Revenue at Risk Solution

Revenue@Risk® analysis is a unique, proprietary analytic methodology that quantifies the financial impact of customer problems to answer these key business questions:

- Which experiences matter most to the recurring revenue and profit potential of my business?

- Which CX moments of truth are causing the greatest risk to my top line?

- What specific CX actions should I prioritize to improve my market share?

The qualitative phase was followed by a quantitative study with a broad base of the Clients’ nearly 1,500 customers whereby deep analysis quantified the damage to loyalty for both the Client’s brand and for its Dealer network. The analysis cut through the complexity of the customer experience by identifying which specific problems created the highest risk for dissatisfaction.

Key Insights

-

Not all problems were created equal

Of the nearly 80 problems posed to customers, less than half had an impact on Brand or Dealer loyalty. -

14 problems damaged both Brand and Dealer loyalty

And accounted for 80% of Brand loyalty risk and 66% of Dealer loyalty risk. Most of the shared loyalty damage arose from equipment operation issues. -

The most damaging problems with Dealers that differed from those most damaging to the Client brand were

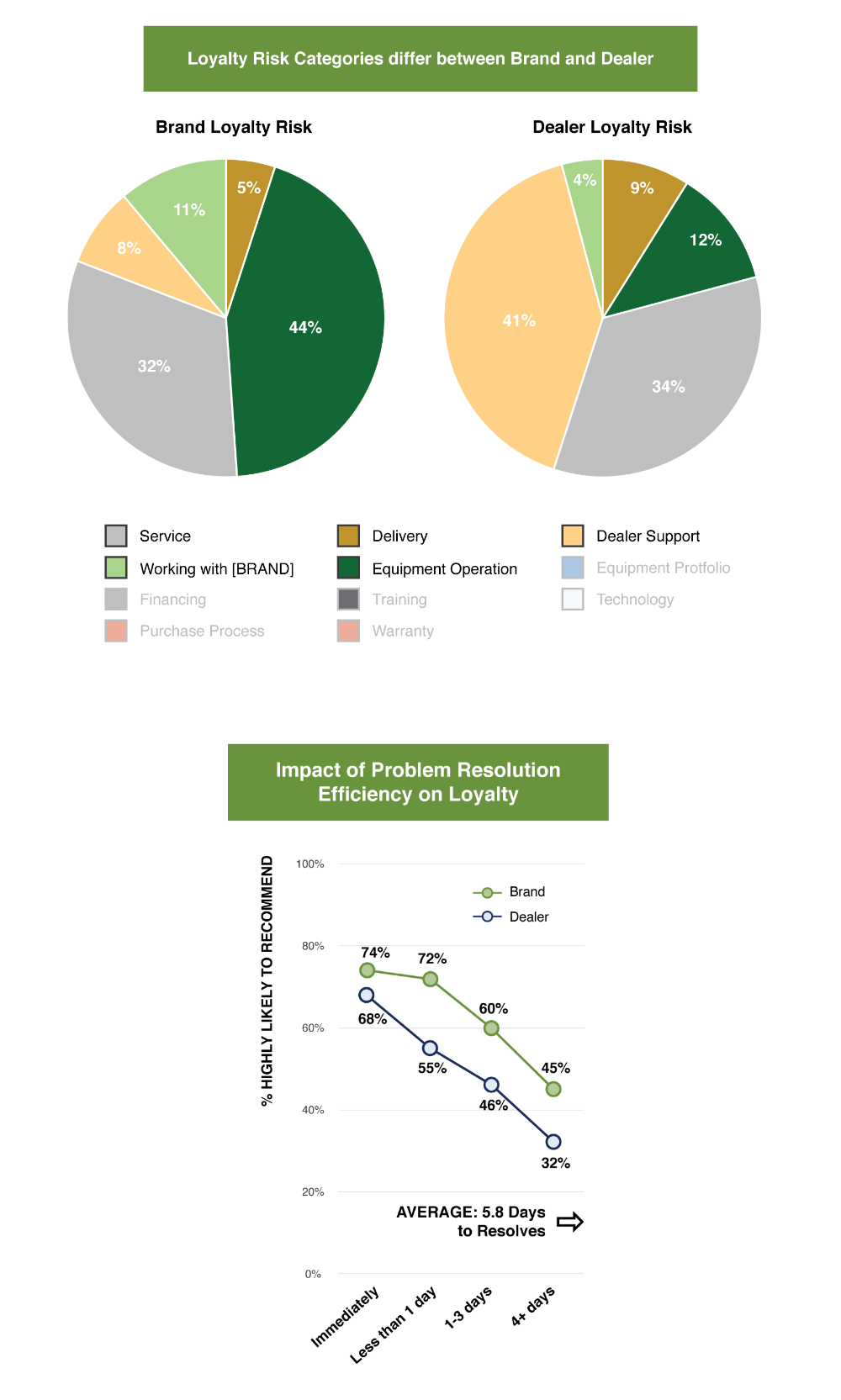

My Dealer does not proactively reach out to me to ask if I need assistance with anything. My Dealer did not keep me informed about upcoming maintenance needed for my equipment. It took too long for the Dealer to repair my equipment. The below pie chart highlights the most damaging problem categories differ for customers when they interact with the Dealer vs the Clients’ corporate brand. This insight speaks to the criticality of delivering a satisfactory customer experience across all distribution channels and the important role of the Dealer network in delivering on the experience. While brands often have less “control” of the Dealer experience, it is strategically important for a brand to have a strategy to support their Dealer network in the delivery of that experience. -

Problems lower loyalty more than Satisfaction Drivers raise loyalty

On average, experiencing a Most Damaging Problem (MDP) reduced construction segment customer loyalty to the Brand by twice as much as high performance on a Loyalty Driver lifts Brand loyalty. -

Speed of problem resolution was a key competitive risk area

Analysis showed that Brand and Dealer loyalty dropped precipitously as time-to-resolve elongated. The Client was averaging nearly six (6) days to resolve problems which put them in the “danger zone” where loyalty was nearly cut in half. (see line chart below)

Impact and Outcomes

Verde facilitated detailed action planning workshops with the to prioritize solutions to address the most damaging problems (MDPs). The action planning process supported the Client in cutting through the complexity of CX by helping to bring strategic focus to the problems that have the greatest impact on loyalty. Through facilitated exercises, the Client determined 25 improvement initiatives.

- The analysis substantiated the negative experiences impact customer loyalty more than positive experiences. As a result, the Client recognized the need to revisit their customer experience measurement strategy for the organization.

- Given that equipment a shared problem area for both Client and Dealer was equipment operation, the Client implemented more stringent QC standards during the engineering and manufacturing stages.

- The Client recognized the critical role of the Dealer network in the experience and endeavoured to work closely with them to make them aware of the problems that eroded Dealer loyalty and to support them in improving the CX by introducing new tools and standards.