Case Study Pharmaceutical & Medical

Delivering a Successful Product Launch Through the Sales Organization

The Pharmaceutical industry has undergone significant growth in the past two decades with worldwide revenues in 2020 of $1.27 tr USD. The North American market accounted for 48 percent of total global revenues. Pharmaceuticals is only one part of the North American health care market, but it is an industry that is highly competitive and highly innovative as pharmaceutical companies focus on the research, development, production and distribution of medicines to address health issues and serious diseases.

Client Background

The Client is a global pharmaceutical organization specializing in the development of breakthrough drugs for serious diseases. They were preparing to introduce a new drug therapy into the North American market and were developing a go to market plan. In particular, the Client wanted to strengthen the company’s market position by understanding the criteria for a successful product introduction so that they could effectively support their sales force for success.

They sought to understand:

- What activities are most important to primary care physicians in a product launch

- The primary drivers of dissatisfaction that would put the launch at risk

- Skills and competencies physicians value in their sales rep

- Physicians’ satisfaction with and opinions of the key competitors

How We Helped

The Client engaged The Verde Group to deliver a Performance@Risk analysis that would help them deeply understand what was required of their sales organization and their channels to successfully launch the product.

Our Revenue at Risk Solution

Revenue@Risk® analysis is a unique, proprietary analytic methodology that quantifies the financial impact of customer problems to answer these key business questions:

- Which experiences matter most to the recurring revenue and profit potential of my business?

- Which CX moments of truth are causing the greatest risk to my top line?

- What specific CX actions should I prioritize to improve my market share?

The analysis uncovered in detail which moments of truth matter for a successful product launch and where there were current points of friction in the sales experience both at the Client and with key competitors that could impede product success.

Key Insights

The Performance@Risk analysis produced several fresh insights incremental to the client’s go-to-market intelligence and helped them to establish a clearer product positioning and go to market approach.

-

There were two key competitors (A and B) but the strategies required to differentiate from them differed

Competitor A had a customer experience profile that indicated a few significant problems existed for physicians that were broad in nature and entrenched in the organization. Physicians were 25% less likely to continue to do business with A than B. This represented an opportunity for the Client to position their product as a replacement to competitor A’s product.

Competitor B’s sales reps were 6 times more likely to be identified as “Best” than Competitor A and their customer experience profile was more positive than that of A’s. This represented an opportunity for the Client to position their product as a supplement to competitor B’s product. -

Drive awareness to drive results

While the Client had very strong brand equity with physicians who knew them, only 1/3 of their target market were aware of them and had clear impressions of their company and their products. There was an opportunity to broaden awareness and reach through their go to market and channel strategies to drive physician acquisition. -

The sales team is the difference

Convenient physician education matters to loyalty and was a problem for physicians today. All organizations had an opportunity to improve on this, but Competitor A had the highest loyalty risk due to deficiency in this area.

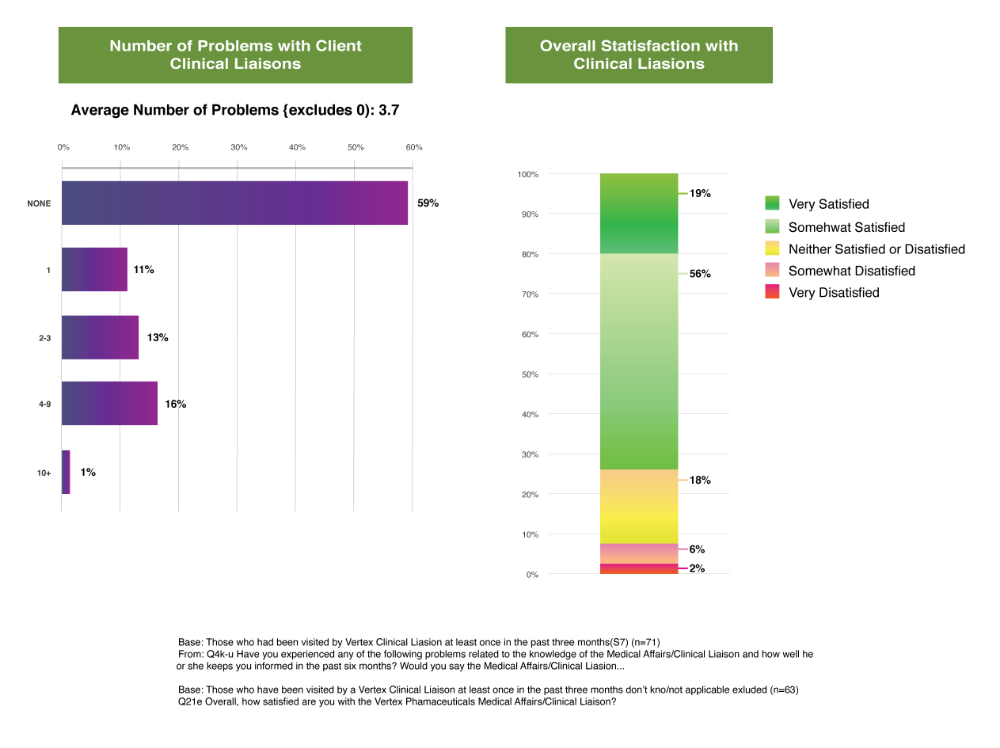

Both the clinical liaisons and the sales team were material drivers of product adoption and loyalty for physicians. Physician satisfaction with the Clients clinical liaisons was only 50% of their satisfaction with the clinical liaisons of Competitor B.

The chart below indicates the Clients’ clinician liaisons were also underperforming with the majority of physicians indicating they had not specific problems, but the majority were only somewhat satisfied with their liaison.

Impact and Outcomes

The Client and The Verde Group conducted an action planning workshop with Client executive. Several go to market initiatives were executed based on specific findings from the study:

Modification of the Sales Representative Competency Model

Data was so compelling in this area that leadership adjusted both the hiring profile and the training curriculum for sales staff to ensure that they were emphasizing desired skills and attributes most important to the new product target audience.

Modifications to the Go-To- Market Marketing Plan

Given the opportunity to raise awareness of the Client organization, incremental marketing and channel dollars were allocated during the launch to drive brand awareness.

Individualized Sales Plans Were Created

The Verde Group worked with the Client to conduct a follow up study to complement this analysis. The study allowed the Client to better understand their highest value prospects and to look more intensely at the critical loyalty behaviours and attitudinal markers that best characterized each physician. As a result, sales staff were then able to develop individualized sales plans for each high value physician prospect.