“Customers who had the best past experiences spend 140% more compared to those who had the poorest past experiences.”

Nearly three decades ago, Jones and Sasser published the infamous piece “Why Satisfied Customers Defect”. Many companies conduct regular customer satisfaction research with the belief that there’s a direct link between customer satisfaction and revenue — improving the first will drive an increase in the second. Yet, for the past 28 years, companies have invested billions in measuring the customer experience using attitudinal metrics such as overall satisfaction, NPS or other “I love you” metrics. This fact, coupled with a November 2022 study conducted by Forrester indicating that 1 in 5 CX programs will be eliminated in 2023, suggests that something is in need of significant repair in the CX measurement ecosystem .

In 2018, Verde Group published the below blog, which we believe holds true today. Our premise is that experiences (not attitudes) predict how customers will behave in the future and that negative experiences (CX friction) is much more predictive of negative market action than positive experiences. It’s simply how we’re wired as humans.

_____

Many companies conduct regular customer satisfaction research with the belief that there’s a direct link between customer satisfaction and revenue — improving the first will drive an increase in the second. Many also rely heavily on the results of the customer satisfaction survey to build and execute action plans to drive future customer satisfaction. And so the cycle repeats.

It turns out that these companies could be making a very costly error. Customer satisfaction is a very poor predictor of future customer behaviors. Just because a customer says they’re satisfied doesn’t mean they’ll come back to buy a company’s products or use their services.

A different (and counter-intuitive) approach bears more fruit. Satisfaction is an attitude, and attitudes depend on what a customer experiences with a company or brand. It is these customer experiences — especially negative ones — that are most influential on customer loyalty and value. Consequently, customer experiences are much more useful for predicting future customer actions. If you want to know what your customers will do in the future, it’s not enough to ask them how satisfied or unhappy they are — you need to dig deep into their experiences that are shaping their attitudes.

Why are negative experiences (or problem experiences, as The Verde Group considers them) so influential? It’s evolutionary: as human beings, we’ve evolved to respond more strongly to negative experiences than positive ones, which makes negativity a much more powerful motivator than happiness. This is a significant consideration in evaluating the customer experience. When customers have a problem experience, they’re more likely to take action (they will shop somewhere else) and much more likely to tell others about their experience than if they’ve had a positive experience. Simply put, it’s at that moment when companies are upsetting their customers the most that it’s easiest to predict what those customers will do in the future.

Traditional customer satisfaction surveys are simply not designed to gather the level of detailed feedback required to understand negative customer experiences. For example, imagine a customer is asked to comment on something they’re not satisfied with, and their reply is ‘clerk friendliness’. The meaning is directionally clear but specifically ambiguous. That ambiguity will make it difficult (if not impossible) for a company to create an action plan to effectively fix the problem. What exactly needs to change for the clerk to be more friendly?

If companies dig deeper, however, and truly understand the customer experiences that led to that attitude, it would provide the insight necessary to hire the right personnel and create training programs. Embracing this paradigm means organizations need to take a completely different approach when evaluating their customer experiences.

An honest dialogue with customers is the most effective way to expose problems and the root causes behind them. Acknowledging that your company is not perfect — that you know you make mistakes and are committed to fixing them — is a great start. But a link can be made between improving the customer experience and increasing revenue, with much more certainty than the link between customer satisfaction and revenue.

Retailers, in particular, are blessed with a wealth of customer data that can be integrated with experiential survey responses to establish which problems are driving loss of share and perhaps outright defection. Armed with a much more predictive view of future customer behavior based on evaluating the customer experience, companies can create a clear picture of how taking particular actions to improve that experience will impact the bottom line.

Today’s shoppers still remain loyal to their favorite brands, but they are increasingly cost and experience conscious. In order to maintain loyalty and share of wallet, retailers not only need to know what makes their customers happy but, more importantly, pro-actively address – and reduce – the critical problems customers face. A problem-free shopping experience is the best way to create and keep a loyal customer.

April 9, 2018 Author: The Verde Group

_____

Moving Beyond Satisfaction to a Metric That Matters…

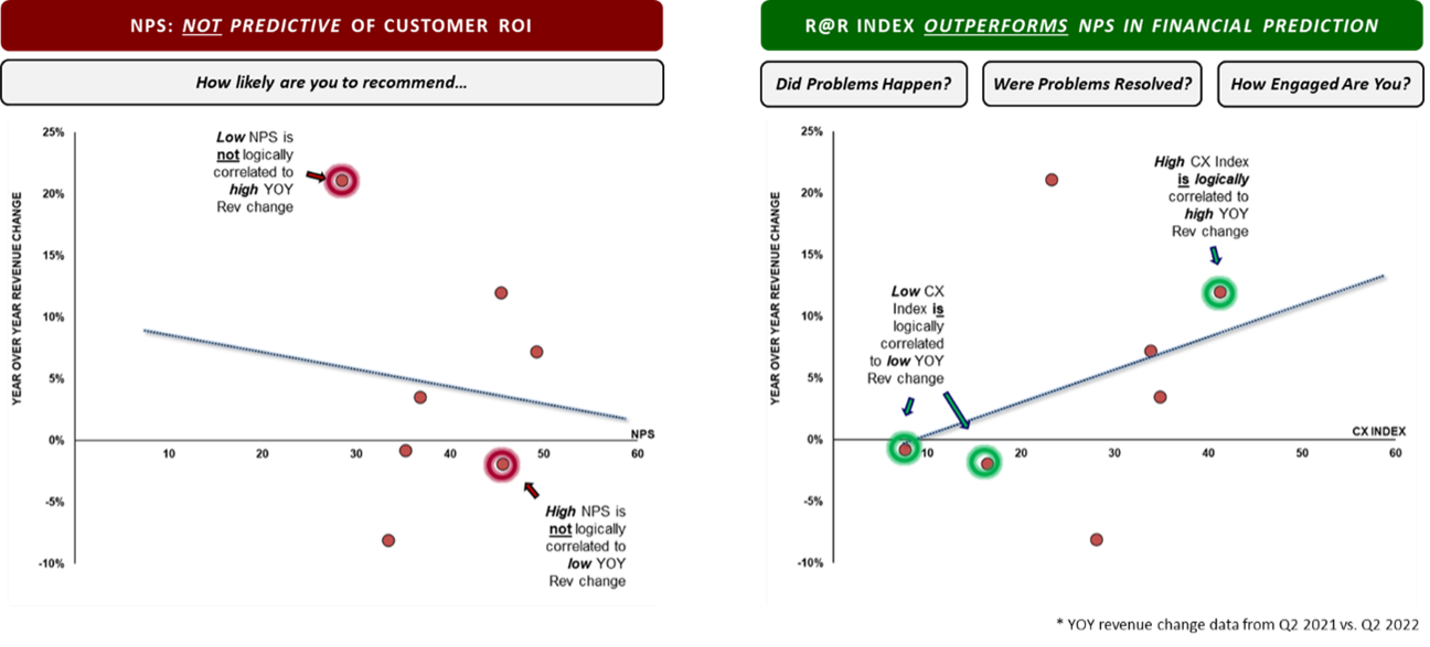

This can be a sensitive topic for some organizations that have a long history of tracking CX performance and/or have compensation and development opportunities associated with improving CX metrics. But if these metrics are attitudinal in nature, risk exists. As covered above, many attitudinal metrics simply do not correlate to changes in financial performance and thus beg questions in the boardroom. This is why Verde Group is bullish on the Revenue@Risk® Index which combines three variables – the absence or presence of most damaging CX problems, the efficacy of service recovery and the degree of non-transactional engagement – to more accurately measure the holistic impact of the customer experience on business performance.

We compared NPS and Verde Group’s Revenue@Risk® Index to annual changes in year-over-year revenue for multiple brands:

In the end, organizations that:

- Understand the specific experiences the drive customer behaviors,

- Have a thorough understanding of the efficacy of their service recovery efforts, and

- Consistently strive to increase non-transactional customer engagement,

have a tremendous opportunity to increase revenue and profits while keeping their CX programs front and center with the C-Suite.

August 4, 2023 Author: Dennis Armbruster, Executive Vice President, The Verde Group