Private equity (PE) has become a driving force in the business world, fueling growth and innovation across various industries. One crucial aspect of this investment strategy is due diligence, the comprehensive assessment of a target company before an acquisition. While financial metrics and operational efficiencies are often prioritized during due diligence, an equally important aspect that is gaining prominence is the evaluation of customer experience (CX). In an age where customers hold immense power, PE firms are recognizing that a strong customer experience can directly impact a company’s success.

The Evolution of Due Diligence

Traditionally, due diligence focused heavily on financial analysis, legal compliance, and operational efficiency. However, as the business landscape evolved, so did the understanding of what constitutes a valuable and sustainable investment. The emergence of the experience economy, where customer interactions and perceptions hold immense sway, shifted the spotlight to the customer experience. Today, savvy investors understand that a company’s financial health is intrinsically linked to its ability to deliver an exceptional customer experience.

Understanding Customer Experience in Due Diligence

Customer experience encompasses all interactions a customer has with a brand, from the first point of contact through to post-purchase support. A positive customer experience results in brand loyalty, repeat business, and positive word-of-mouth recommendations. And a negative experience can have an equally and often more consequential negative financial impact. Dissatisfied customers buy less, spread negative word of mouth and stop buying altogether – the ultimate financial consequence.

A Better Way

Financial due diligence involves a comprehensive examination of a target company’s financial health, performance, and risks. And it typically includes a review of financial statements, analysis of quality of earnings, and working capital assessment to name a few. When it comes to due diligence on the off-balance sheet assets, such as customer experience, the metrics are limited.

The common process for many PE firms is to understand a company’s Net Promoter Score(NPS). The thinking here is that if a company has a high NPS score, then the company has strong customer equity. But there is a growing body of evidence that NPS has a limited relationship to financial performance. According to a quote cited in NPS’ early days by the MIT Sloan Management Review, “ The Net Promoter Score metric does not measure customer loyalty as effectively as other metrics and is a poor predictor of growth relative to other measures of customer satisfaction.” So, is NPS enough? Even when supplemented with customer interviews, the amount of CX due diligence done by PE firms is shockingly limited. How can a PE firm truly understand the extent of risk related to sub-par customer experiences which may be pervasive but unknown through traditional NPS survey results?

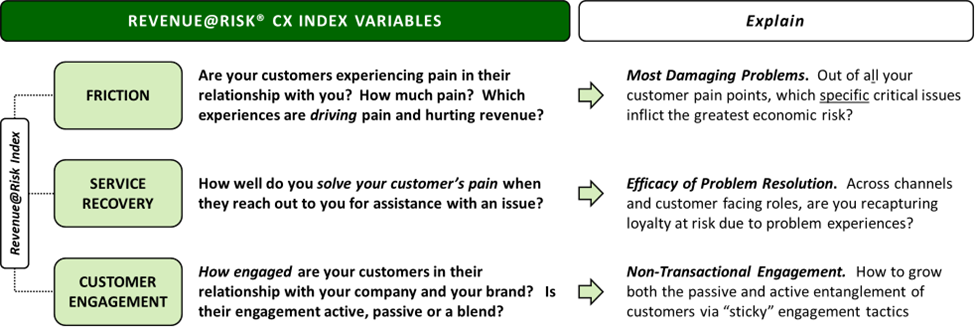

Verde Group has found that when measured correctly, there can be a strong positive correlation between key customer metrics and YOY revenue growth. Understanding 3 key elements of a customer’s experience is critical:

Benefits of CX-Centric Due Diligence

- Reduced Risk: Companies with a strong customer experience strategy are often better equipped to weather market fluctuations. Customer loyalty can act as a stabilizing force even in uncertain times.

- Enhanced Value Creation: PE firms that prioritize customer experience during due diligence unlock opportunities for value creation. By identifying areas for improvement, they can work with the acquired company to enhance CX and, consequently, the bottom line.

- Long-Term Growth: A focus on customer experience aligns with long-term growth objectives. Happy customers become brand advocates, leading to sustainable revenue streams.

- Market Differentiation: In competitive markets, exceptional customer experiences differentiate a brand from its competitors. PE firms that foster such differentiation are better positioned for success.

Conclusion

Private equity must evolve beyond its traditional financial lens and embrace the significance of customer experience. Due diligence around CX is no longer optional; it’s a strategic imperative. As PE firms recognize the correlation between strong customer experiences and financial success, they must integrate thorough assessments of a company’s CX strategies and metrics into their investment processes. By understanding the financial impact – both good and bad – of customer experience, PE firms are not only contributing to the growth of their portfolio companies but also shaping a business landscape where customer-centricity reigns supreme.

Want to find out how the Verde Group can help you, your business, and your investments? Let’s talk.

Sign up for our monthly newsletter for more CX insights like this and more.

Author: Paula Courtney, Chief Executive Officer, The Verde Group