“… CX Index metric correlates to changes in year-over-year financial performance and that it can serve as a leading indicator of future economic performance.”

…………………………………………………………………………………………………………………………………………………………………………

By Dennis Armbruster,

Executive Vice President – The Verde Group

As customers return to brick-and-mortar stores, retailers face headwinds like never before — margins are tighter, finding staff remains challenging, wages are rising and, well, there are those nagging supply chain issues…

For years, retail leaders have been told the key to delivering on shareholder value would be found in effectively measuring and managing customer relationships and improving their experience. But, quite frankly, many of them just don’t believe it anymore or they remain on the fence, unconvinced. And with good reason: reliance on certain metrics, like customer satisfaction and/or Net Promoter Score (NPS), hasn’t consistently yielded significant improvement in the CX and, more importantly, their bottom line.

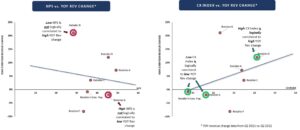

In fact, a quantitative analysis recently conducted for a major national retailer led Verde to confirm what we suspected —NPS, while interesting, simply does not correlate to changes in financial performance. Why? Because measures that focus on understanding a customer’s attitude and not the actual experiences driving customer behavior, are generally unreliable when trying to impact financial performance.

Instead, Verde theorized the key was to economically quantify the risks associated with specific problems in three ways:

- First, focusing on measuring the absence or presence of friction in the CX — and not just any friction points, those most damaging to customer behavior. In other words, separating the noise from signal.

- Second, we looked at the efficacy of service recovery. Unfortunately, many companies make it difficult for customers to contact them. But when they do, it represents a great opportunity to rebuild loyalty. Addressing problems completely when they occur can repair the relationship with customers who experience a negative interaction and reduce its downstream impact on financials.

- Third, we measured the degree of non-transaction brand engagement — those “sticky” behaviors that increase the odds of your marketing message getting through and can reduce the cost to serve customers.

By combining the above variables and scoring individual customers, we created a CX Index score for each brand studied — including our client. The results suggested that the CX Index metric correlates to changes in year-over-year financial performance and that it can serve as a leading indicator of future economic performance. This was not the case with NPS.

So why should companies consider this CX Index, anyway?

In short, we found that the CX Index cut through the clutter and honed in on what really mattered. Verde has been working closely with the CX Index’s first two variables for 20+ years — we have literally hundreds of examples indicating that there’s a direct relationship between absence or presence of most damaging problems and great service recovery on customer behavior. The third variable — non-transactional engagement — rounds-out the dynamics of the customer experience and plays a key role in customer retention and marketing message receptivity.

What comes next?

With the CX Index in our toolbelt, we believe we now have a better way for companies to effectively measure customer experience performance and demonstrate how CX investments translate to economic performance.

But now the hard part: how to translate that knowledge and insight into action? How to get a company to rally around, fix problems and address opportunities? It’s a heavy lift, to be sure, but it really starts with the facts. As we often say, it’s all about the money and we believe that linking CX performance to financials is the key to driving and sustaining change.